Overview

As plan sponsors begin to evaluate plan design changes for the coming year, MedCost wants to ensure awareness of the amounts for out-of-pocket limits, HDHP minimum deductibles, and inflation adjusted HSA contribution limits for 2022, as determined by the Department of Health and Human Services and the IRS.

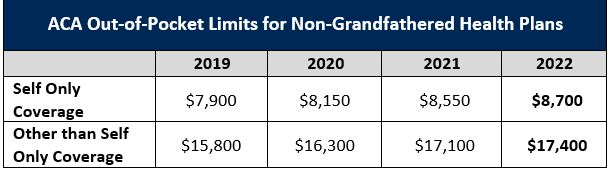

Out-of-Pocket Limits

The table below shows final increases to the out-of-pocket maximum dollar limits for plan years beginning January 1, 2022, as well as the changes in out-of-pocket limits from 2019 to 2022. (Final regulations for 2022 from the Department of Health and Human Services available here). Note that the 2022 amounts represent an increase of 1.8% from the 2021 maximums.

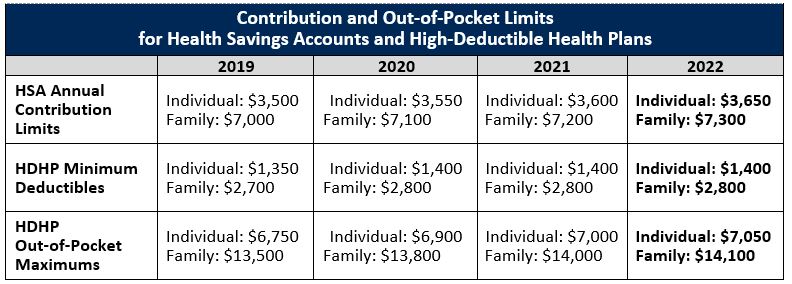

HDHP Limits

The table below shows the inflation-adjusted contribution, deductible, and out-of-pocket dollar limitations for health savings accounts (HSAs) and high-deductible health plans (HDHPs) for calendar year 2022, as well as the limit changes from 2019 through 2022. (For more information, see IRS Revenue Procedure 2021-25.)

Interaction Between Two Out-of-Pocket Limits

Employers who sponsor health plans that must comply with both the ACA and IRS out-of-pocket limits should note that the ACA limits continue to be higher than the IRS amounts. In 2022, the ACA limit for self-only coverage will be $1,650 more than that for HDHPs and $3,300 more for family coverage.

Please contact your MedCost Account Manager if you have any questions.