Overview

As plan sponsors begin to evaluate plan design changes for the coming year, MedCost wants to ensure awareness of the amounts for out-of-pocket limits, HDHP minimum deductibles, out-of-pocket maximums, and inflation adjusted HSA contribution limits for 2023, as determined by the Department of Health and Human Services and the IRS. Additionally, it is important to note that the referenced changes below are effective upon a plan’s prospective renewal date. (For more information, see Q&A-86 in IRS Notice 2004-50.)

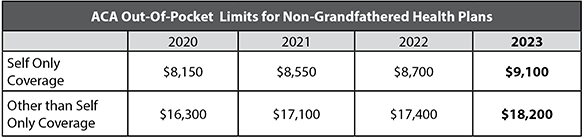

Out-of-Pocket Limits

The table below shows final increases to the out-of-pocket maximum dollar limits for plan years beginning January 1, 2023, as well as the changes in out-of-pocket limits from 2020 to 2023. (Final regulations for 2023 from the Department of Health and Human Services available here). Note that the 2023 amounts represent an increase of 4.6% from the 2022 maximums.

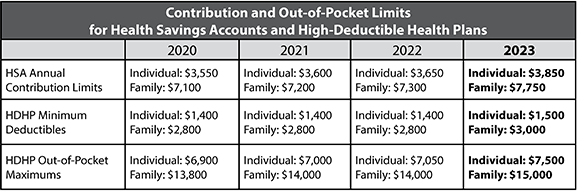

HDHP Limits

The table below shows the inflation-adjusted contribution, deductible, and out-of-pocket dollar limitations for health savings accounts (HSAs) and high-deductible health plans (HDHPs) for calendar year 2023, as well as the limit changes from 2020 through 2023. (For more information, see IRS Revenue Procedure 2022-24.)

Interaction Between Two Out-of-Pocket Limits

Employers who sponsor health plans that must comply with both the ACA and IRS out-of-pocket limits should note that the ACA limits continue to be higher than the IRS amounts. In 2023, the ACA limit for self-only coverage will be $1,600 more than that for HDHPs and $3,200 more for family coverage.

Please contact your MedCost Account Manager if you have any questions.