Overview

As plan sponsors begin evaluating plan design changes for the 2026 plan year, MedCost would like to highlight key IRS and Department of Health and Human Services updates. These include the inflation-adjusted contribution limits for Health Savings Accounts (HSAs), as well as the minimum deductible and out-of-pocket maximums for High-Deductible Health Plans (HDHPs), and the Affordable Care Act (ACA) out-of-pocket limits for 2026.

Please note that these changes are effective upon a plan’s prospective renewal date. For further guidance, refer to Q&A-86 in IRS Notice 2004-50.

HDHP Limits

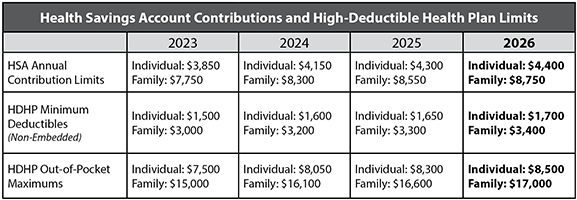

The table below outlines the inflation-adjusted contribution limits for HSAs and the deductible and out-of-pocket maximums for HDHPs for the 2026 calendar year. It also includes a comparison of limit changes from 2023 through 2025. For more information, see IRS Revenue Procedure 2025-19.

For HDHPs with an embedded deductible, the individual deductible must meet or exceed the IRS minimum family deductible to retain HSA-qualifying status. For plan years beginning in 2026, this means the individual deductible must be at least $3,400.

Out-of-Pocket Limits

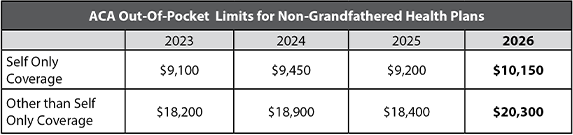

The table below reflects final increases to the ACA out-of-pocket maximum dollar limits for non-grandfathered health plan years beginning January 1, 2026, as well as the changes in out-of-pocket limits from 2023 to 2025. Final regulations for 2026 from the Department of Health and Human Services available here.

Interaction Between Two Out-of-Pocket Limits

Employers sponsoring health plans subject to both ACA and IRS out-of-pocket limits should be aware that the ACA limits remain higher than those set by the IRS. For the 2026 plan year, the ACA out-of-pocket maximum exceeds the HDHP limit by $1,650 for self-only coverage and by $3,300 for family coverage.

Please contact your MedCost Account Manager if you have any questions.