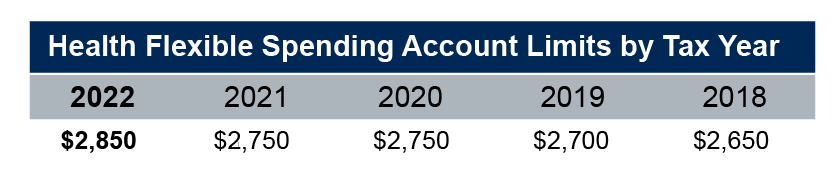

The Internal Revenue Service recently released Revenue Procedure 2021-45, announcing the cost-of-living adjustments for calendar year 2022. The dollar limitation on voluntary employee salary reductions for contributions to health Flexible Spending Accounts (FSA) increased to $2,850 (up from $2,750). If a cafeteria plan permits health FSA carryovers, the maximum amount that can be carried over to the 2023 plan is $570 (up from $550).

For additional guidance on FSAs, please review IRS Publication 969.

If you have any questions, please contact your MedCost Account Manager.