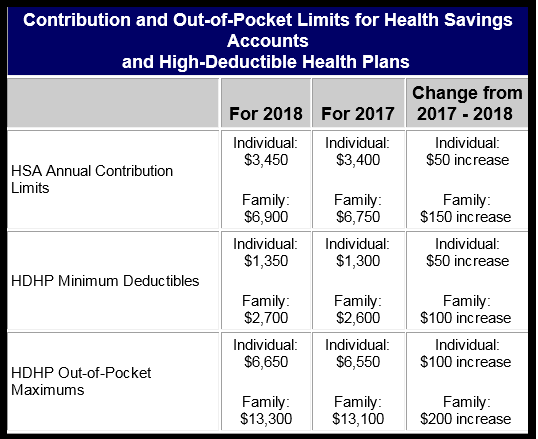

The IRS has released Revenue Procedure 2017-37, setting the 2018 dollar limitations for health savings accounts (HSAs) and high-deductible health plans (HDHPs).

The contribution, deductible and out-of-pocket limitations for 2018 are shown in the table below. All of these amounts are scheduled to increase from 2017. (The 2017 limits are included for reference.)

For guidance on HSAs, please review the IRS frequently asked questions’ page at https://www.irs.gov/publications/p969/ar02.html.

This blog post should not be considered as legal advice.

Add new comment