Self-Funding Is a Growing Option

Employers fight a constant battle between income and expenses. As health care regulations grow more complex, employee benefits become a more critical cost. Continued increases in medical premiums have motivated many employers to examine self-funding as a viable alternative to fully-insured plans.

Self-funding, or self-insurance for employee health benefits, is funded with employer assets and employee contributions. This model of funding gives employers the ability to choose an appropriate level of coverage to fit their employees’ risk and benefits selections.

In 2011, 58.5% of employers who offered health coverage chose self-funded plans—an increase from 40.0% in 1998 (Employee Benefit Research Institute).1

What about catastrophic claims? An employer’s liability for large, unexpected claims is lessened by purchasing stop loss insurance, which limits financial risk from catastrophic claims.2 MedCost highly recommends stop loss coverage be included in all self-funded arrangements.

Self-funded employers capture the opportunity to save money by only paying for actual claims. MedCost partners with consultants and employers to realize potential savings, build customized benefit packages and manage risk.

Fully-Insured or Self-Funded?

Let’s compare fully-insured health plans with a self-funded plan:

| Fully-Insured | Self-Funded |

| *All costs are fixed | *80% variable cost (representing potential employer savings) |

| *Premiums cover all risk & claims | *Stop loss insurance covers catastrophic claims |

| *Federal insurer taxes are required (2%–3% of premium) | *Exempt from federal insurer taxes (employer savings) |

| *State premium taxes are required (2%–3% of premium) | *Exempt from most state premium taxes (employer savings) |

| *Fewer plan choices & less flexible designs | *Custom benefit design & risk selection |

Reward vs. Risk

Potential employer savings with a self-funded plan can be substantial. Savings from exempted federal and state taxes can total 4%–6%, a significant amount year-over-year. Plus, the margin of funds not spent each year can be reserved in the employer’s account for future claims.

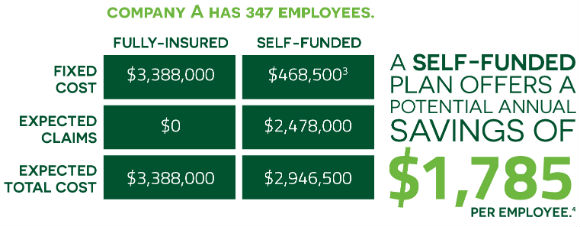

The chart below compares fully-insured and self-funded plans for a hypothetical company with 347 employees. With self-funding, even after paying fixed costs and expected claims, the employer would still keep $619,500 in a company account for future claims.

Through years of experience, MedCost has streamlined financial benefits for consultants and employers in self-funded health plans. Our flexible, integrated choices and cost controls can present a stable alternative to fixed cost insurance plans. For more resources on self-funding, contact your benefits consultant or Laura at MedCost

2In North Carolina, stop loss coverage is permitted for groups with at least 26 eligible employees.

3Based on employer’s net paid claims.

4Per employee per year.

Add new comment