HSA 2018 Contribution Limits Adjusted by IRS

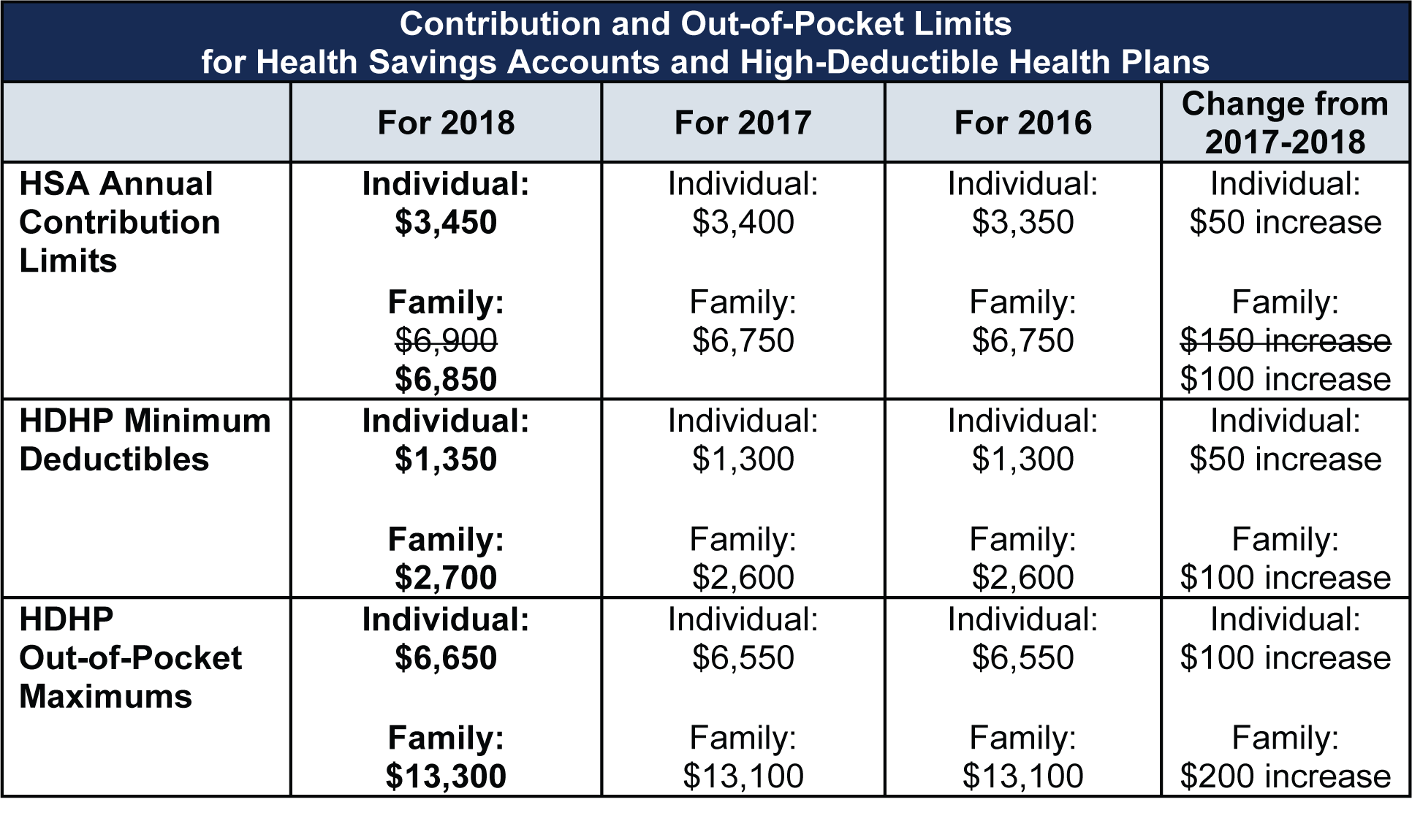

On March 5, 2018, as a result of the tax reform law (P.L. 115-97), the IRS released Bulletin No. 2018-10, adjusting dollar limitations for health savings accounts (HSAs) and high-deductible health plans (HDHPs) for 2018.

The only change impacting HSAs was to adjust the contribution limits for family coverage from $6,900 to $6,850.

HSA 2018 Contribution Limits: FAQs

For guidance on HSAs, please review the IRS frequently asked questions page.

This blog post should not be considered as legal advice.

Add new comment