The Internal Revenue Service recently announced the tax year 2017 annual inflation adjustments for more than 50 tax provisions.

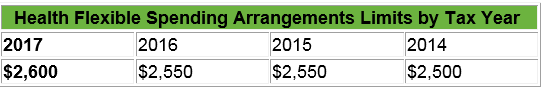

Notably, for the first time in two years and consistent with industry expectations, the IRS has increased the dollar limitation under § 125(i) on voluntary employee salary reductions for contributions to health Flexible Spending Accounts (FSA) from $2,550 to $2,600.

The Revenue Procedure 2016-55 provides details about these annual adjustments. The tax year 2017 adjustments generally are used on tax returns filed in 2018.

For guidance on FSAs, please review the IRS Frequently Asked Questions page.

Add new comment