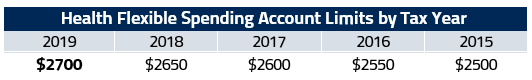

The Internal Revenue Service recently issued Revenue Ruling 2018-57 announcing the cost-of-living adjustments for calendar year 2019. This ruling includes an increase in the dollar limitation under §125(i) on voluntary employee salary reductions for contributions to health Flexible Spending Accounts (FSA) from $2,650 to $2,700.

Important Reminder: All Plan changes must be approved by the Plan Sponsor by way of a Plan amendment, and as such, your flex administrator may not automatically increase the limit for your plan members when an increase is announced by the IRS. If you wish to allow your plan members to increase their annual elections up to the 2019 IRS maximum limit, contact your flex administrator.

For guidance on FSAs, please review the IRS Frequently Asked Questions page.

This blog post should not be considered as legal advice.

Add new comment