The Surprising Ways Millennials Think About Their Health Insurance

The future of healthcare will be driven by Millennials as they are set to overtake Baby Boomers in the workplace as the largest generational group of workers in 2019. Understanding what Millennials think about their health benefits will be critical to better personalizing health benefits for a multi-generational workforce and also to attracting and retaining Millennial talent.

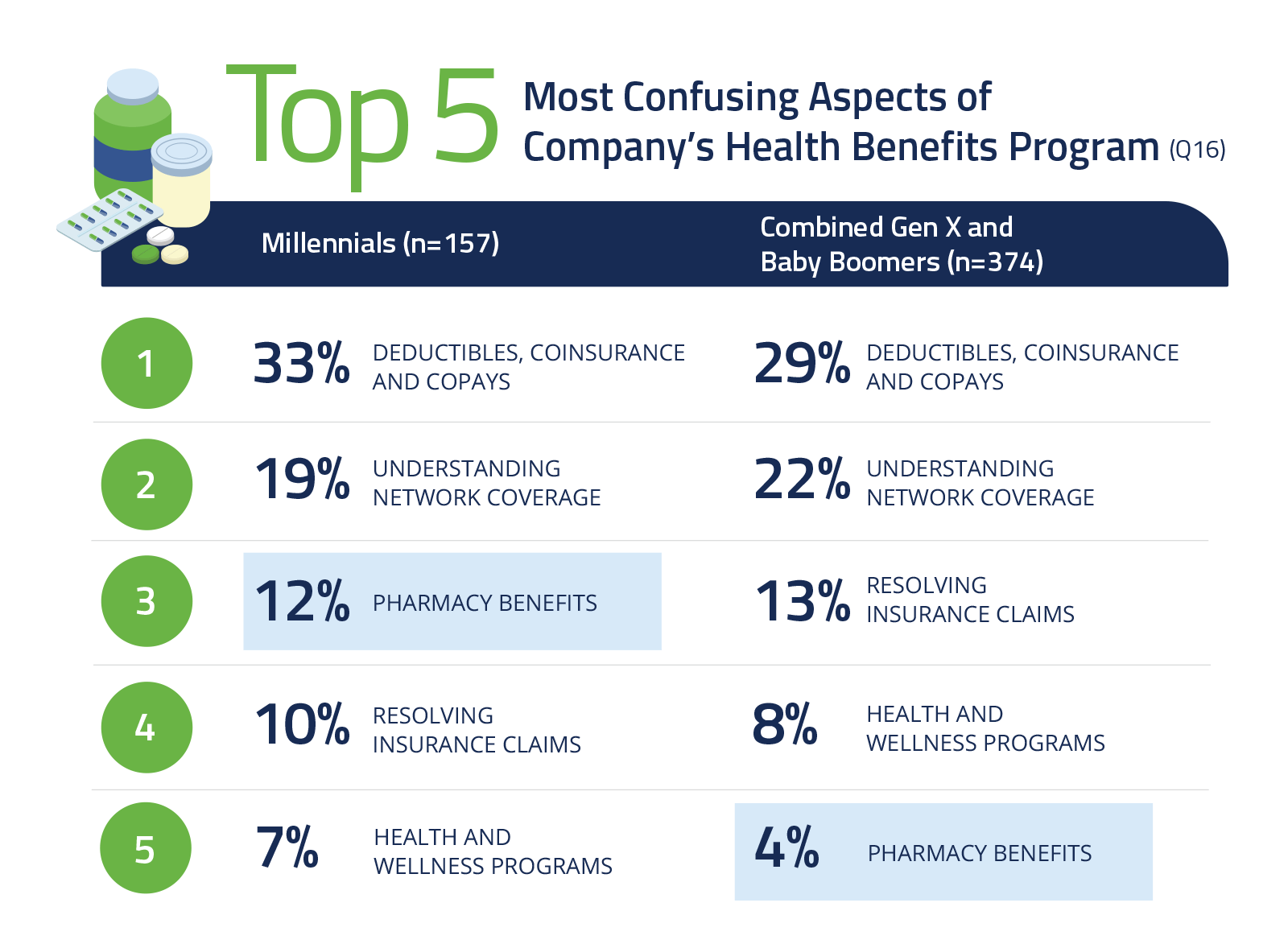

Most Confusing Aspects of Their Health Benefits

On the topic of the most confusing parts of their health benefits, Millennials cited pharmacy benefits otherwise known as prescription drug benefits as a top three confusion area (12%), but this same aspect ranks fifth for the combined Gen X and Baby Boomer generations (4%). This may indicate that Millennials have a stronger desire for education on pharmacy benefit-related topics or how to better navigate this aspect of their benefits.

The above list shows that Millennials reported slightly less confusion around resolving insurance claims, possibly because they deal with insurance claims less frequently or because pharmacy benefits are a more immediate financial concern compared to older generations. This also could indicate that Millennials are less concerned about going “out-of-network” and incurring fees. Millennials are less likely to cover more than two family members under their health benefits compared to older generations. With fewer family members covered comes a lowered chance for unexpected insurance claims.

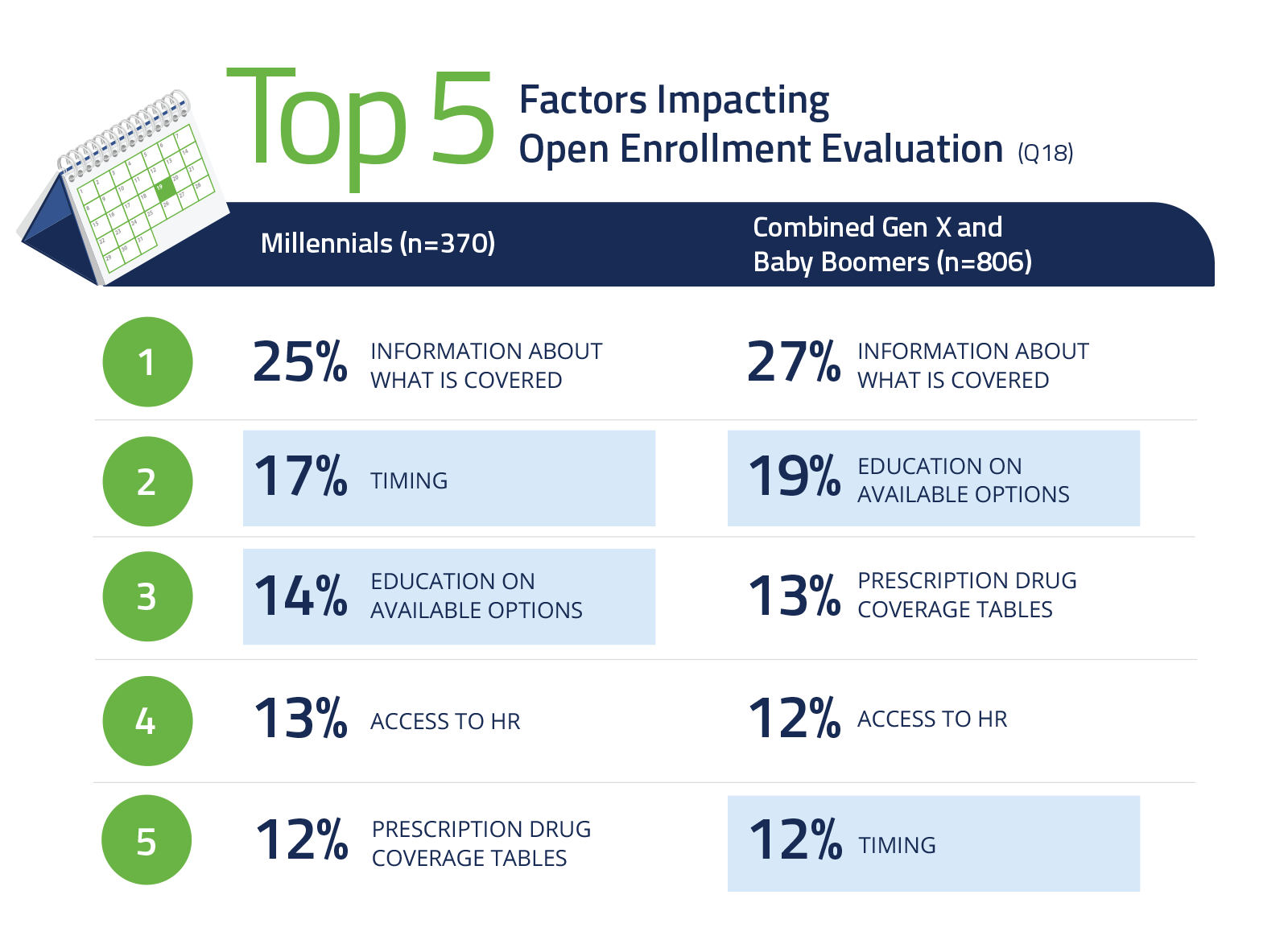

Their Evaluation Factors Impacting Open Enrollment

Millennials have a different set of evaluation factors they value during open enrollment than their older generation counterparts. Beyond wanting to know the basic details about their coverage, Millennials state “timing” as the second biggest factor on their ability to evaluate benefit options—older generations ranked this as their fifth biggest factor.

Given the younger age of Millennials, “timing” might indicate that they have less experience with open enrollment as a group or that they want to understand their options or future health benefits in greater depth before enrolling. The previous question shows just how important “pharmacy benefits” are to Millennials, so they may want to see how these may be affected before enrolling. Put simply, Millennials may need more time to evaluate their options than their older coworkers, so allow at least two to four weeks for open enrollment.

Why This Matters for Your Health Benefits Program

Millennials think about their health benefits differently than older generations—understanding these needs today will help you design attractive company health benefits and also better tailor the open enrollment experience for your employees. As a health benefits administrator, MedCost has the insight and experience to personalize your company’s health benefits to attract the type of talent you seek most. Contact your health benefits advisor today to learn how MedCost can bring the Benefits Balance™ to your organization.

Add new comment