Stop Loss Insurance Protects Self-Funded Plans from Large Claims

As the cost of health care continues to rise, many businesses are exploring self-funded health plans as a way to gain control of costs.Employers who designate funds to pay their companies’ health claims buy stop loss insurance to protect assets in the event of catastrophic claims.

MedCost is offering a free white paper,explaining how stop loss insurance works. Here is an excerpt describing how employers can maximize benefits while minimizing risk:

TWO TYPES OF STOP LOSS COVERAGE

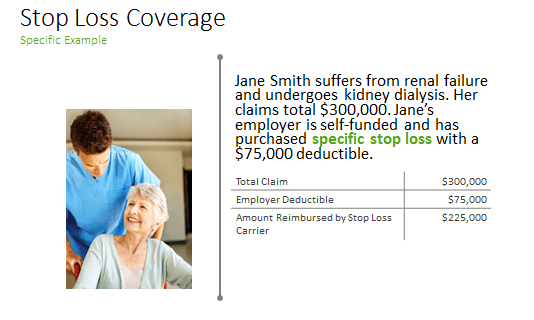

Specific (or individual) stop loss insurance limits the self-funded employer’s liability to a predetermined dollar amount (specific deductible) for each employee covered under the health plan. The specific deductible per employee is determined by group size and risk tolerance.

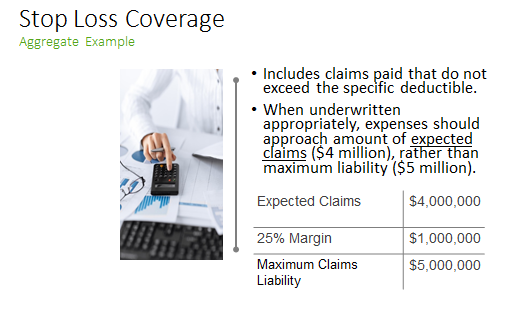

Aggregate stop loss insurance limits the self-funded employer’s overall liability. Maximum liability is determined by projecting expected claims plus a margin (typically 25%). If paid claims exceed 125%, the stop loss carrier reimburses the amount above the maximum liability. Individual claims that exceed the specific deductible do not accumulate toward the aggregate. Only claims up to the specific deductible apply to the aggregate deductible.

Stop Loss Coverage

The Stop Loss Coverage white paper answers key questions on how to choose the best stop loss partner, strategies for rewards versus risk, contracts and more. Download a free copy of the stop loss white paper.

Add new comment