One-Fourth of Employers Now Offering CDHPs to Avoid Tax

Employers continue to take action to avoid the looming excise or “Cadillac” tax on more expensive health insurance for their employees. This Affordable Care Act tax of 40% annually is currently set to take effect in 2020, but it is already having a major impact.

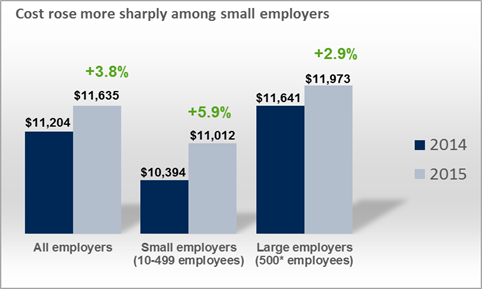

A 2015 Mercer study found that total health benefits cost averaged $11,635 per employee.[i] This average amount exceeds theCadillac tax’s threshold of $10,200 for individuals, and would trigger the 40% tax on benefits above the threshold. And small employers are seeing higher increases in medical, dental and other health benefits than large employers.

Employers Turn to Consumer Plans

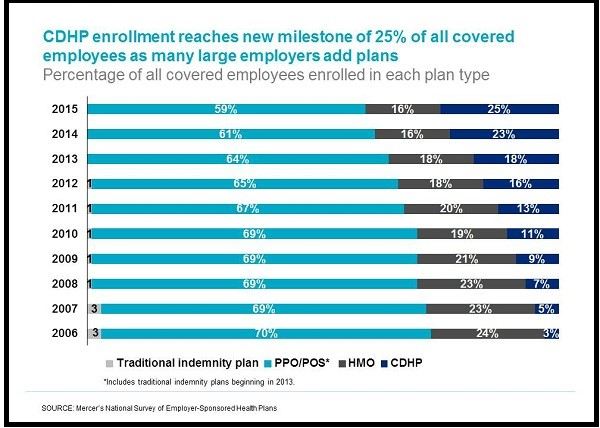

For the first time, 25% of covered employees are now enrolled in Consumer-Driven Health Plans (CDHP). Large employers of 20,000 or more employees have added CDHPs the fastest (73%). A projected 34% of employers with 50+ employees will be subject to the excise tax in 2020 if they make no changes to their current health plans.

High-Deductible Health Plans (HDHP) are a type of Consumer-Driven Health Plans. Employers are saving an average of 18% with an HSA-eligible HDHP instead of a traditional Preferred Provider Organization (PPO) plan.[ii]

One key reason that employees are researching medical costs in advance for services such as maternity care, joint replacements and Emergency Room visits. A 2015 Consumer Health Insights’ survey showed that 22% always talked to others about costs or searched websites for information.[iii]

Employees who have a telemedicine option in their health plans can choose a more appropriate level of care for certain respiratory infections, fevers and nausea (see “Treatment Alternatives to the Emergency Room”). Choosing the right level of care reduces time away from work, boosting productivity. And employees save unnecessary dollars from their own pockets.

Some employers offer pricing transparency tools such as HealtheReports™ which compares costs for a complete procedure. Employees can review local facilities that offer mammograms, colonoscopies, X-rays and other services. HealtheReports also lists comments from members about their recommendations for health care organizations.

A New Era in Health Care

CDHP plans require a shift in thinking about medical spending. In traditional plans, employees are used to handing over their insurance card and paying a small copay.

It can come as a jolt to employees to realize that CDHP coverage begins with paying expenses up to a higher deductible before insurance kicks in. For this reason, employers must proactively educate employees when introducing CDHP options.

Our next blog will detail key steps for employers to take in providing tools for smart decision-making. Employers who can manage staff expectations with a balanced understanding of the changing health care industry will build a productive partnership with your team.

[i] “With the Excise Tax in Their Sights, Employers Hold Health Benefits Cost Growth to 3.8% in 2015,” Mercer Global, November 19, 2015, http://www.mercer.com/newsroom/national-survey-of-employer-sponsored-health-plans-2015.html (accessed August 8, 2016)

[ii] Ibid.

[iii] “Debunking Common Myths about Healthcare Consumerism,” McKinsey & Company, December 2015, http://www.mckinsey.com/industries/healthcare-systems-and-services/our-insights/debunking-common-myths-about-healthcare-consumerism(accessed August 11, 2016)

Add new comment