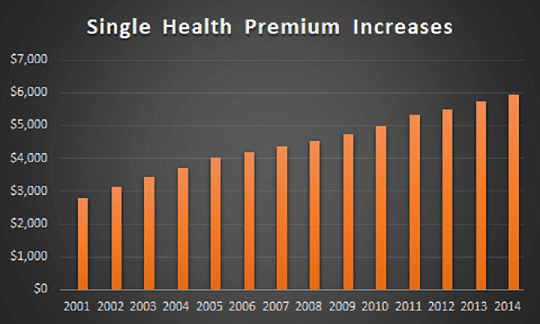

Single Employee Insurance Up 48% from 2005-2014

It’s no surprise to employers that health premiums continue to take a bigger spending bite every year. Single employee premiums jumped 48% from 2005 to 2014, reported the Congressional Budget Office (CBO) in February 2016.[i] Estimates at 5% annual growth mean that the cost of insuring employees will outpace average income per capita by two percentage points per year.

The CBO projects average premiums for employer-based coverage at $10,000 for individuals and about $24,500 for family coverage in 2025—an almost 60% increase from 2016.

Costs for government subsidized health insurance will top $600 billion this year. And most Americans who receive subsidies are working full-time. The Affordable Care Act (ACA) will account for $110 billion in subsidies.

Looming over employers is the Cadillac tax on more expensive health care insurance. Currently the 40% tax is set to take effect in 2020 (see “Cadillac Tax Revisions” blog), but ACA requirements are impacting employer planning for health benefits.

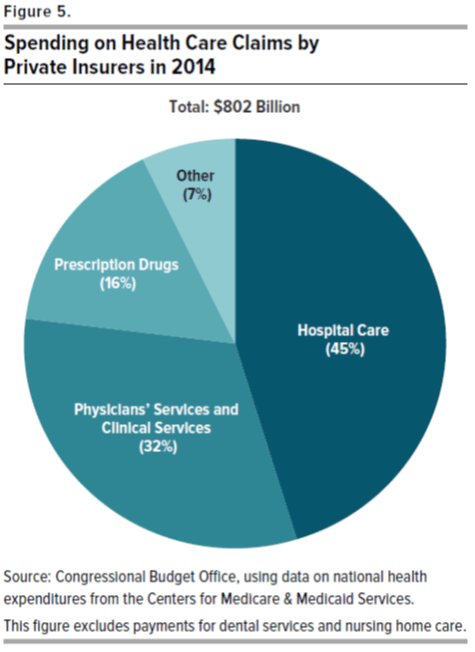

Since an average 62% of American employees still get their health coverage at work, tracking health care spending remains a major concern for businesses.[i]

Costs for government subsidized health insurance will top $600 billion this year. And most Americans who receive subsidies are working full-time. The Affordable Care Act (ACA) will account for $110 billion in subsidies.

Looming over employers is the Cadillac tax on more expensive health care insurance. Currently the 40% tax is set to take effect in 2020 (see “Cadillac Tax Revisions” blog), but ACA requirements are impacting employer planning for health benefits.

Since an average 62% of American employees still get their health coverage at work, tracking health care spending remains a major concern for businesses.[i]

As health care laws continue to change, employers must work closely with consultants and benefits administrators who have expert knowledge to get the best performance from every health care dollar.

[i] “Update from 2015 Employer Health Benefits Survey,” Kaiser Family Foundation, February 5, 2016, http://kff.org/private-insurance/issue-brief/a-comparison-of-the-availability-and-cost-of-coverage-for-workers-in-small-firms-and-large-firms-update-from-the-2015-employer-health-benefits-survey/ (accessed April 28, 2016)

[i] “Private Health Insurance Premiums and Federal Policy,” Congressional Budget Office, February 11, 2016, https://www.cbo.gov/publication/51130 (accessed April 4, 2016).

Add new comment