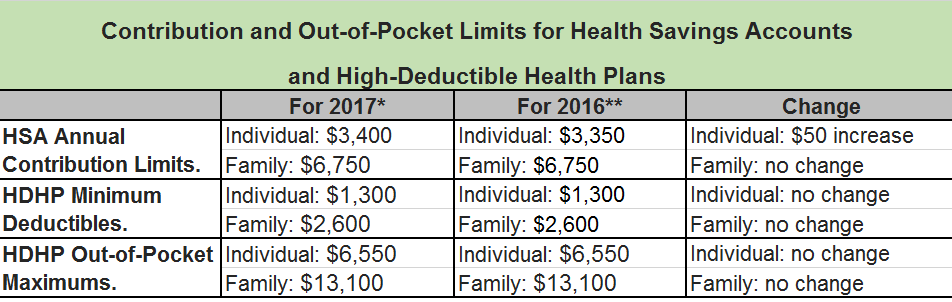

The IRS has released the 2017 cost-of-living adjusted limits for health savings accounts (HSAs) and high-deductible health plans (HDHPs). The only change from 2016 is a $50 increase in the annual HSA contribution limit for individuals with self-only HDHP coverage. All of the other amounts are unchanged from 2016.

For guidance on HSAs, please review the IRS frequently asked questions page at https://www.irs.gov/publications/p969/ar02.html or contact Jason at j[email protected].

*Rev. Proc. 2016-28 (Apr. 28, 2016), available at https://www.irs.gov/pub/irs-drop/rp-16-28.pdf

**Rev. Proc. 2015-30 (May 5, 2015), available at https://www.irs.gov/irb/2015-20_IRB/ar07.html

Add new comment